So, let’s start with this: Range Resources Breakeven Costs Indeed, as I’ll explain in just a moment, NGLs account for around 29% of RRC’s total energy-equivalent output and are crucial to underpinning my fair value estimate, and bullish outlook, for the stock. However, the majority of RRC’s acreage produces so-called wet gas, which is a mixture of methane (natural gas) as well as natural gas liquids (NGLs) including propane, ethane, butane and natural gasoline. The Marcellus is a widely distributed shale play located in Appalachia and it’s primarily considered a natural gas field. In this issue, I’ll use a similar methodology for Range Resources ( NYSE: RRC), a company with over 500,000 net acres located in the Marcellus Shale field in Pennsylvania. Therefore, to recommend buying an E&P, I’m looking for stocks trading at a significant discount to my estimated fair value thus, even if commodity prices disappoint, there’s room for the stock to rally.

The energy business is cyclical as are, of course, commodity prices.

Refined storage exporter vs importer free#

Second, I examine the current calendar strip pricing for crude oil, natural gas liquids (NGLs) and natural gas and calculate the value of the producer’s production based on the mix of hydrocarbons produced.įinally, I use this model to estimate the company’s free cash flow potential over the next few years and derive a discounted cash flow (DCF) target price for the stock.

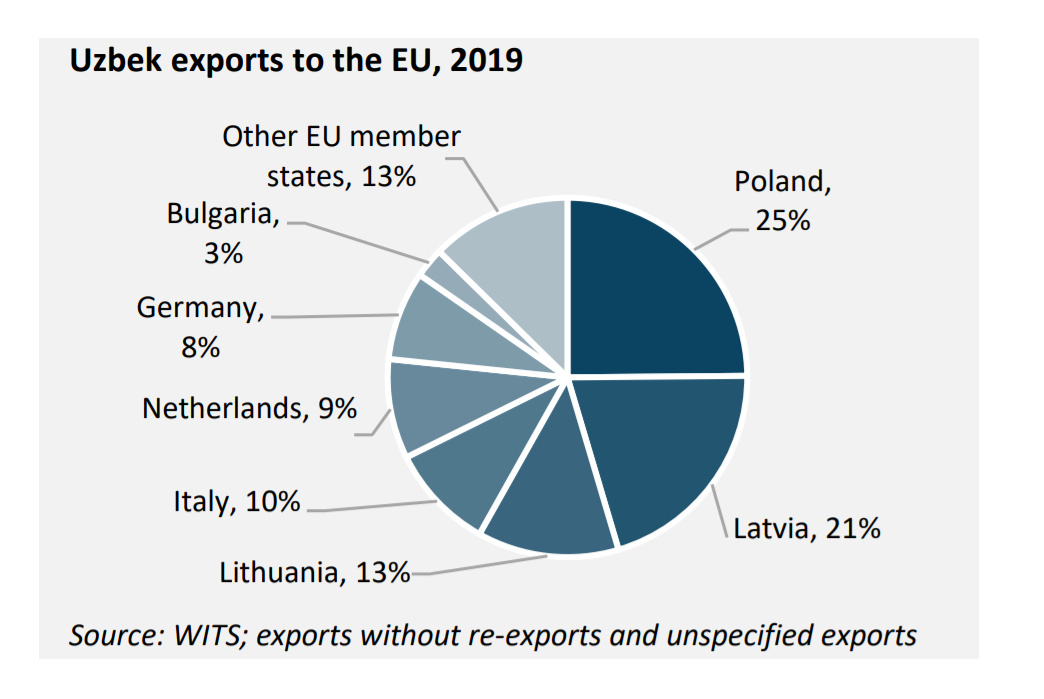

My approach to valuing these companies is straightforward and consists of three main steps.įirst, I create a simple model of the producer’s cash flow breakeven costs based on management’s guidance for capital spending, hedges, costs, and production potential. Over the past two months I’ve written three pieces covering US oil and natural gas exploration & production (E&P) companies including a hold rating on Devon Energy ( DVN), a bullish piece on gas-focused producer Southwestern Energy ( SWN ) published in early May, and a bearish article on Comstock Resources ( CRK ) back in late April.

0 kommentar(er)

0 kommentar(er)